this post was submitted on 17 Nov 2025

976 points (99.0% liked)

memes

18046 readers

2366 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads/AI Slop

No advertisements or spam. This is an instance rule and the only way to live. We also consider AI slop to be spam in this community and is subject to removal.

A collection of some classic Lemmy memes for your enjoyment

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

In all fairness, it would be some kind of custom Neural Network designed to try and predict market movements (having been trained with past market data as well as things like counts of specific words in news articles and social media posts within a certain time frame) rather than an LLM.

Neural Networks are pretty good at spotting patterns in masses of data which people can't easilly spot.

Of course, there must be a pattern there which doesn't change much over time of certain things happening with more probability after certain other combinations of things, for it to actually beat the market, plus it also massivelly depends on the inputs it's formatted to take (which a human is deciding rather than the NN itself, though maybe the technique used in LLMs of having huge dimensionality in terms of inputs and internal layers might work well there so that it can take "everything but the kitchen sink" as inputs).

And then, there is of course the "small" risk that it might work fine for months/years under normal market conditions at doing what is essentially "picking nickles in front of a steamroller" - i.e. making low value gains in a nice reliable away for as long as normal market conditions are happening, but when conditions change getting totally splattered - whilst because of the whole black-box nature of NNs the humans don't recognize the convoluted technique it has converge to use through training, as that kind of risky strategy.

That said, unlike an LLM at least a custom NN wouldn't come up with a "you're so right" excuse when the human tells it of the massive losses it incurred.

Trading firms have been using ML and Neural Nets for trading and investment insight for ages before the current LLM "AI" boom started. I knew someone working in that space on investment derivatives in the mid 2010s.

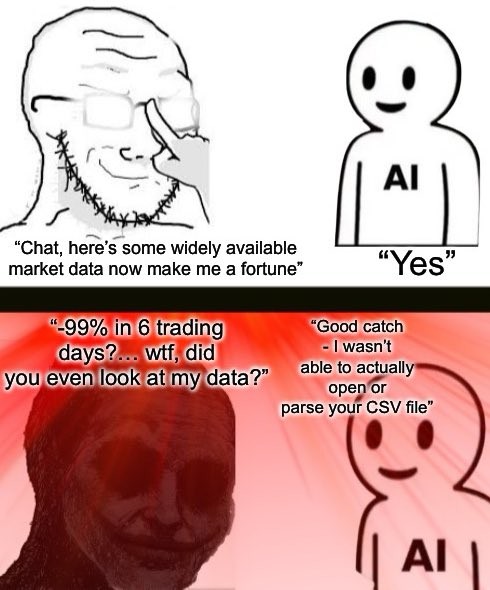

You don't really need to speculate on it. It's old news. This is just a joke about how there's a new crop of suckers who are absolutely using LLMs for stock advice.

Makes sense.

I left the Finance Industry at about the time when ML in machine trading was just starting to be thought about and never got involved in it (or even Machine Trading) so I wasn't sure it was happening, but knowing what I know of the industry it makes total sense that they would at least try it out since they have tons of in-house developers and can afford to pay a lot for domain-relavant expertise.

PS: Also for example things like Neural Networks have been in used since the 90s in other domains and Finance seems to take around a decade or decade and a half to catch up to Tech in terms of Software.

It's true that NNs are strong at spotting patterns in masses of data, but trading is a particularly hard problem for this kind of task because the market constantly adapts to its participants. If other traders have found a pattern, it will already be priced in when you try to make money off it, and your strategy will fail. And since trading is a worldwide competition with billions of dollars to be won, you are naturally competing against teams of the best of the best who are willing to put massive resources into their algorithm development, computing, and data acquisition. Therefore the chances for someone like us to find an algorithm that systematically beats them is very low.

So for any young math/CS nerd who comes across this thread and wants to try their luck, be aware of the difficulty before you invest any real money, and learn about the merits of passive investing.

Yeah, thanks for pointing that out.

I kind approached it in another post I made here about this when I mentioned that "all the human perceived patterns have already been spotted and arbitraged away" as part of explaining why NNs would end up with convoluted opaque strategies, but only thought about "and existing NNs operating on the Market probably do the same for NN-level strategies" without actually writing it.

By the way, my post isn't meant to support people making NNs to trade, it's just a bit of blue sky thinking from somebody with some expertise in both worlds and barely begins to dig into the problems of it, thus not covering things - such as you pointed out - like how safe and reliable market strategies (human-powered or NN-powered) sooner or later get arbitraged away.